Buying a car is a significant milestone. For many people, it represents financial achievement, personal independence, and convenience in everyday life. Because a vehicle is such a valuable asset, protecting it—and yourself—against unexpected events becomes essential. One of the most reliable ways to safeguard that investment is by purchasing automobile insurance. The right insurance policy does far more than simply pay for repairs; it can provide financial protection, legal support, and peace of mind. Understanding how automobile insurance works, as well as knowing the different types of available coverage, can help you make an informed decision and comply with the requirements of your state.

How Automobile Insurance Works: The Basics

Automobile insurance is a contractual agreement between you and an insurance company. You pay a recurring fee known as a premium, and in return, the insurer agrees to cover specific losses or expenses outlined in your policy. These losses may arise from accidents, theft, natural disasters, or other unforeseen incidents.

Most auto insurance policies cover three primary areas:

1. Property Coverage

This portion of your policy pays for damage to your car or covers you in the event your vehicle is stolen. Depending on the type of policy, it may apply to repairs, replacements, or other associated costs.

2. Liability Coverage

Liability insurance protects you if you are responsible for harming another person or damaging someone else’s property while driving. It can cover medical expenses, repair bills, and even legal judgments if you are sued after an accident.

3. Medical Coverage

Medical coverage helps pay for hospital visits, rehabilitation, surgery, and—in tragic cases—funeral expenses. It may apply to you, your passengers, and in some situations, family members driving your vehicle.

Although nearly every U.S. state requires drivers to carry some form of auto insurance, the exact requirements vary widely. State laws typically include minimum liability limits, but the recommended amount of coverage often exceeds these minimums to ensure sufficient protection. Most insurance policies are issued for six-month or one-year terms. At the end of each term, your provider will notify you when it is time to renew and pay your next premium.

Why You Need Auto Insurance

1. Protect Your Vehicle

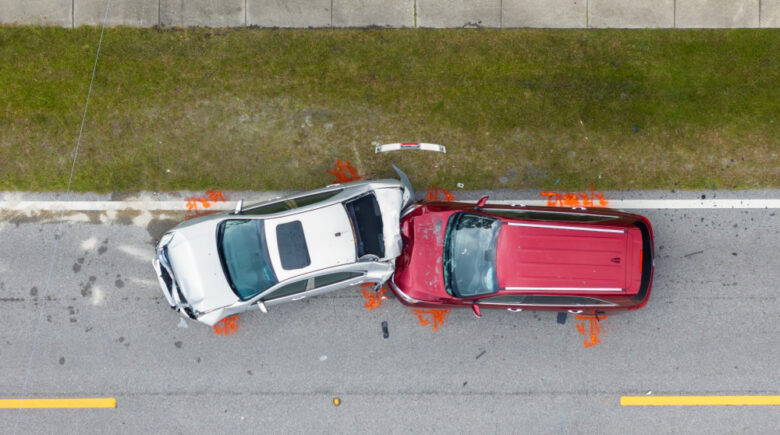

A primary reason to purchase auto insurance is to shield your vehicle from financial loss. Even the most experienced driver can face unexpected hazards—icy roads, distracted motorists, falling tree branches, or sudden mechanical failures. A comprehensive insurance policy can cover the cost of repairs or replacement after a collision or incident. Beyond accidents, comprehensive coverage can protect your vehicle against fire, vandalism, theft, explosions, and damage caused by natural disasters such as floods or storms. Without insurance, these costs fall entirely on you and can be financially overwhelming.

2. Protect Yourself and Others

Accidents can happen in seconds, but the consequences may last much longer. Medical expenses following a crash can be substantial—even a minor accident may require X-rays, emergency room visits, or physical therapy. More serious collisions may involve surgeries, long-term rehabilitation, or extended hospital stays. Auto insurance can help cover these expenses for both you and your passengers, reducing the financial strain during an already stressful time. By having adequate coverage, you ensure that an unexpected accident does not turn into a long-term financial burden.

3. Cover Third-Party Damages

Third-party damages can be especially costly. If you damage someone else’s vehicle, property, or injure a pedestrian or motorist, you may be held financially responsible. Liability insurance ensures these expenses are covered without draining your personal savings. This type of coverage is essential not only for meeting legal requirements in most states but also for protecting your financial future. Without it, even a single mistake on the road could lead to thousands—or even hundreds of thousands—of dollars in liability.

4. Protect Yourself From Legal Expenses

Lawsuits related to car accidents are increasingly common. If another party decides to sue you for damages, your insurance policy can cover legal fees, settlements, and other court-related costs. Attorney fees and court expenses can add up quickly, making legal protection one of the most valuable aspects of a comprehensive auto insurance policy. Knowing you are protected can give you greater confidence and peace of mind every time you drive.

Types of Automobile Insurance Coverage You May Need

Liability Coverage

Liability coverage is mandatory in most states, except South Carolina, New Hampshire, and Virginia. It covers the costs associated with injuring another person or damaging their property in an accident that you cause. This includes medical bills, car repairs, and legal judgments. Liability insurance is typically offered as a package consisting of bodily injury liability and property damage liability.

Uninsured and Underinsured Motorist Coverage

Not all drivers carry adequate insurance, despite legal requirements. If an uninsured driver hits your vehicle, uninsured motorist coverage can pay for your medical bills or repair costs. Underinsured motorist coverage applies when the at-fault driver has insurance, but their policy limits are too low to cover all your expenses. Several states require these coverages, but even where they’re optional, they are highly recommended for added protection.

Comprehensive and Collision Coverage

Comprehensive and collision insurance are usually sold together and provide extensive protection for your vehicle. Collision coverage pays for damage resulting from crashes with other cars or fixed objects. Comprehensive coverage applies to non-collision events like theft, natural disasters, vandalism, floods, or animal strikes. If your car is financed or leased, your lender will likely require both.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers regardless of who is at fault. In addition to medical bills, it may reimburse lost wages, rehabilitation costs, and other services not covered by traditional health insurance. Some states require PIP, while in others it is optional.

Medical Payments Coverage (MedPay)

Similar to PIP but more limited, Medical Payments Coverage helps pay for medical expenses such as hospital visits, X-rays, and surgery. It applies to you, your household members, and passengers in your vehicle.

How to Purchase Auto Insurance

When shopping for auto insurance, avoid focusing solely on the cheapest price. Insurance companies use different formulas to calculate premiums, so costs can vary significantly among providers. To find the best value, request quotes from multiple insurers or work with a licensed insurance broker who can help you compare your options.

Ask about available discounts as well. Many insurers offer savings for safe drivers, students with good grades, vehicles with advanced safety features, bundling home and auto policies, and more. Taking advantage of these discounts can significantly reduce your insurance costs while ensuring strong protection.

Buying a car is a significant milestone. For many people, it represents financial achievement, personal independence, and convenience in everyday life. Because a vehicle is such a valuable asset, protecting it—and yourself—against unexpected events becomes essential. One of the most reliable ways to safeguard that investment is by purchasing automobile insurance. The right insurance policy does far more than simply pay for repairs; it can provide financial protection, legal support, and peace of mind. Understanding how automobile insurance works, as well as knowing the different types of available coverage, can help you make an informed decision and comply with the requirements of your state.

How Automobile Insurance Works: The Basics

Automobile insurance is a contractual agreement between you and an insurance company. You pay a recurring fee known as a premium, and in return, the insurer agrees to cover specific losses or expenses outlined in your policy. These losses may arise from accidents, theft, natural disasters, or other unforeseen incidents.

Most auto insurance policies cover three primary areas:

1. Property Coverage

This portion of your policy pays for damage to your car or covers you in the event your vehicle is stolen. Depending on the type of policy, it may apply to repairs, replacements, or other associated costs.

2. Liability Coverage

Liability insurance protects you if you are responsible for harming another person or damaging someone else’s property while driving. It can cover medical expenses, repair bills, and even legal judgments if you are sued after an accident.

3. Medical Coverage

Medical coverage helps pay for hospital visits, rehabilitation, surgery, and—in tragic cases—funeral expenses. It may apply to you, your passengers, and in some situations, family members driving your vehicle.

Although nearly every U.S. state requires drivers to carry some form of auto insurance, the exact requirements vary widely. State laws typically include minimum liability limits, but the recommended amount of coverage often exceeds these minimums to ensure sufficient protection. Most insurance policies are issued for six-month or one-year terms. At the end of each term, your provider will notify you when it is time to renew and pay your next premium.

Why You Need Auto Insurance

1. Protect Your Vehicle

A primary reason to purchase auto insurance is to shield your vehicle from financial loss. Even the most experienced driver can face unexpected hazards—icy roads, distracted motorists, falling tree branches, or sudden mechanical failures. A comprehensive insurance policy can cover the cost of repairs or replacement after a collision or incident. Beyond accidents, comprehensive coverage can protect your vehicle against fire, vandalism, theft, explosions, and damage caused by natural disasters such as floods or storms. Without insurance, these costs fall entirely on you and can be financially overwhelming.

2. Protect Yourself and Others

Accidents can happen in seconds, but the consequences may last much longer. Medical expenses following a crash can be substantial—even a minor accident may require X-rays, emergency room visits, or physical therapy. More serious collisions may involve surgeries, long-term rehabilitation, or extended hospital stays. Auto insurance can help cover these expenses for both you and your passengers, reducing the financial strain during an already stressful time. By having adequate coverage, you ensure that an unexpected accident does not turn into a long-term financial burden.

3. Cover Third-Party Damages

Third-party damages can be especially costly. If you damage someone else’s vehicle, property, or injure a pedestrian or motorist, you may be held financially responsible. Liability insurance ensures these expenses are covered without draining your personal savings. This type of coverage is essential not only for meeting legal requirements in most states but also for protecting your financial future. Without it, even a single mistake on the road could lead to thousands—or even hundreds of thousands—of dollars in liability.

4. Protect Yourself From Legal Expenses

Lawsuits related to car accidents are increasingly common. If another party decides to sue you for damages, your insurance policy can cover legal fees, settlements, and other court-related costs. Attorney fees and court expenses can add up quickly, making legal protection one of the most valuable aspects of a comprehensive auto insurance policy. Knowing you are protected can give you greater confidence and peace of mind every time you drive.

Types of Automobile Insurance Coverage You May Need

Liability Coverage

Liability coverage is mandatory in most states, except South Carolina, New Hampshire, and Virginia. It covers the costs associated with injuring another person or damaging their property in an accident that you cause. This includes medical bills, car repairs, and legal judgments. Liability insurance is typically offered as a package consisting of bodily injury liability and property damage liability.

Uninsured and Underinsured Motorist Coverage

Not all drivers carry adequate insurance, despite legal requirements. If an uninsured driver hits your vehicle, uninsured motorist coverage can pay for your medical bills or repair costs. Underinsured motorist coverage applies when the at-fault driver has insurance, but their policy limits are too low to cover all your expenses. Several states require these coverages, but even where they’re optional, they are highly recommended for added protection.

Comprehensive and Collision Coverage

Comprehensive and collision insurance are usually sold together and provide extensive protection for your vehicle. Collision coverage pays for damage resulting from crashes with other cars or fixed objects. Comprehensive coverage applies to non-collision events like theft, natural disasters, vandalism, floods, or animal strikes. If your car is financed or leased, your lender will likely require both.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers regardless of who is at fault. In addition to medical bills, it may reimburse lost wages, rehabilitation costs, and other services not covered by traditional health insurance. Some states require PIP, while in others it is optional.

Medical Payments Coverage (MedPay)

Similar to PIP but more limited, Medical Payments Coverage helps pay for medical expenses such as hospital visits, X-rays, and surgery. It applies to you, your household members, and passengers in your vehicle.

How to Purchase Auto Insurance

When shopping for auto insurance, avoid focusing solely on the cheapest price. Insurance companies use different formulas to calculate premiums, so costs can vary significantly among providers. To find the best value, request quotes from multiple insurers or work with a licensed insurance broker who can help you compare your options.

Ask about available discounts as well. Many insurers offer savings for safe drivers, students with good grades, vehicles with advanced safety features, bundling home and auto policies, and more. Taking advantage of these discounts can significantly reduce your insurance costs while ensuring strong protection.